|

|

|

|

| | | | | | Last Week in Review: The Fe d met and a Gross Domestic Product was reported. Forecast for the Week:A busy week is ahead, with important news on inflation, manufacturing, and the job market. View: Ever wondered what the world was really like when you were born? Theres a fun way to find out. | | | | | |

| | Last Week in Review  |

|

|

| | | | | | If at first you don't succeed, try, try again. Last week, that popular idiom could have applied to the Gross Domestic Product (GDP) Report. Read on to learn why...and how all the week's news impacted Bonds and home loan rates.  The Advanced GDP reading - or first of three readings - for the 4 th Quarter of 2011 came in at 2.8%, a bit below expectations of 3.2%. This number will be revised two more times, but if the final GDP remains at 2.8%...then the overall GDP for 2011 would be a scanty 1.57%. That is certainly a "Gross" Domestic Product, when you consider that the government has underwritten more than half of that economic growth with the Payroll Tax benefit. The Advanced GDP reading - or first of three readings - for the 4 th Quarter of 2011 came in at 2.8%, a bit below expectations of 3.2%. This number will be revised two more times, but if the final GDP remains at 2.8%...then the overall GDP for 2011 would be a scanty 1.57%. That is certainly a "Gross" Domestic Product, when you consider that the government has underwritten more than half of that economic growth with the Payroll Tax benefit. Also in the news last week, the Fed's Policy Statement after its regularly scheduled Federal Open Market Committee meeting was pretty much the same story as recent Statements, including stable long-term inflation expectations, a tepid economic recovery, and fragile job market. But there was one big exception to their norm. The Policy Statement said there will be "exceptionally low levels for the Federal Funds Rate at least through late 2014." This is a huge change from the previous statements of "low rates until mid-2013." On the surface, extending the zero interest policy until 2015 tells us the Fed thinks the economy will just be slogging along, and accommodative monetary policy will be required to keep the economy growing at least at a modest pace. One could argue that recent economic data is better of late and that all this loose monetary policy is unnecessary. But the Fed has spoken, and as the old adage goes: "Don't fight the Fed." In news out of Europe, yields in European Bonds have come downand by quite a bit. This sparked some optimism that Europe's Long-term Refinance Operation (LTRO) has helped alleviate some pressure in the peripheral countries in the Eurozone, like Spain and Italy. So what's the takeaway? In honor of the upcoming Super Bowl, here's a football analogy: think of the LTRO as a super punt or "kick of the can" down the road. Europe needs to play a serious offensive line by creating a tighter fiscal union, implementing au sterity measures, and developing growth strategies to help pay down the enormous debt. Refinance numbers are expected to increase dramatically over the next numbers of months due to the new HARP Refinance Programs kick off. Arizona Harp Lenders are expected to see the greatest share of these loan requests as the market there has witnessed it’s home values drop extensively. The bottom line is that Bonds and home loan rates remain at historic best levels, which means now is still a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you or your clients. | | | | | |

| | Forecast for the Week  |

|

|

| | | | | | Economic reports will be plentiful - and important - this week: - The week kicks off Monday with the Core Personal Consumption Expenditure (PCE), which is the Fed's favored gauge of inflation. This report will be closely watched, since any hint of an uptick in inflation could push Bond prices lower and, in turn, move home loan rates higher.

- Manufacturing will also be in the spotlight with the Chicago PMI on Tuesday, followed by the ISM Index on Wednesday.

- Consumer Confidence will also be delivered on Tuesday.

- The ADP Private Employment Report will be released on Wednesday and comes before the government's total job's report on Friday.

- As usual, Initial Jobless Claims will be released on Thursday. This week's report comes after an uptick of 21,000 last week.

- Finally, on Friday the government's monthly Employment Report will be released. The Employment Report consists of Non-farm Payrolls, the Unemployment Rate, Average Workweek and Hourly Earnings. This is an important report that can have a big impact on the markets. So I'll be watching it closely.

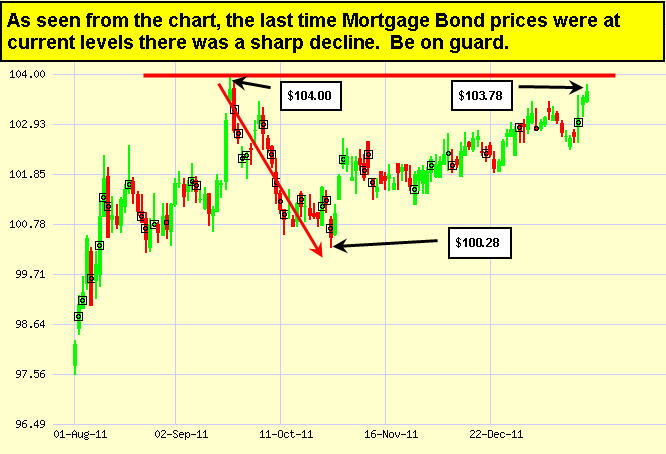

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds and home loan rates remain near their historic bests. I'll be watching closely to see which way they move next. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Jan 27, 2012) | | | | | | |

| | | |

| | | |

NOTE: THIS IS A CONFIDENTIAL AND PRIVILEGED COMMUNICATION. This transmission is intended only for use by the individuals or entities to which it is addressed, and contains confidential and/or privileged information. If the reader of this message is not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please send a reply to us and permanently delete the e-mail from your computer.

Posted via email from philipjensen's posterous